The most important (and often skipped) first step in planning for retirement is identifying date & dollar specific retirement goals. Please see our post about that here!

As part of planning for a successful retirement, each “future retiree” (your employees) can develop a solid foundation and understanding of the impact that each of the following will have on retirement planning:

- life expectancy,

- inflation, and

- asset allocation

These are the key factors in achieving success. Defined as a lifestyle sustaining level of income that increases with inflation, and a legacy for future generations. Yes, EACH employee can do this. You can help.

So what does this mean?

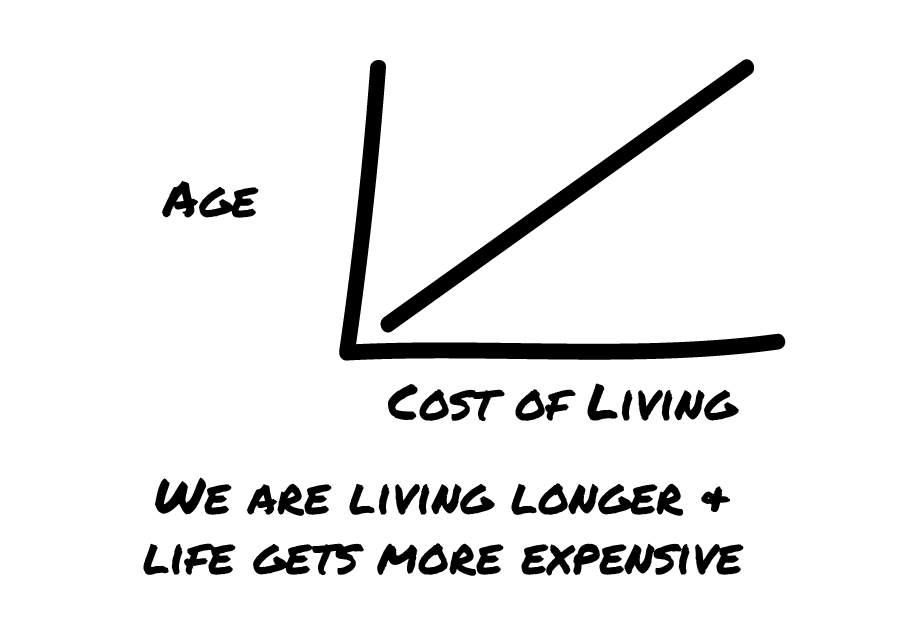

Life expectancy– The average joint life expectancy of a non-smoking married couple exceeds 90 years of age. The average retirement could exceed 30 years!

Inflation –history shows that costs double over the course of 30 years. Fixed income in the face of rising costs could be a big problem.

Asset allocation – the dominant determinant of successful investing, pre-retirement and post-retirement!

Developing a goal that focuses on income at the beginning of retirement is a huge (and great) first step.

Planning for growing this income to accommodate a 30-year retirement helps assure that your future retirees don’t run out of money.