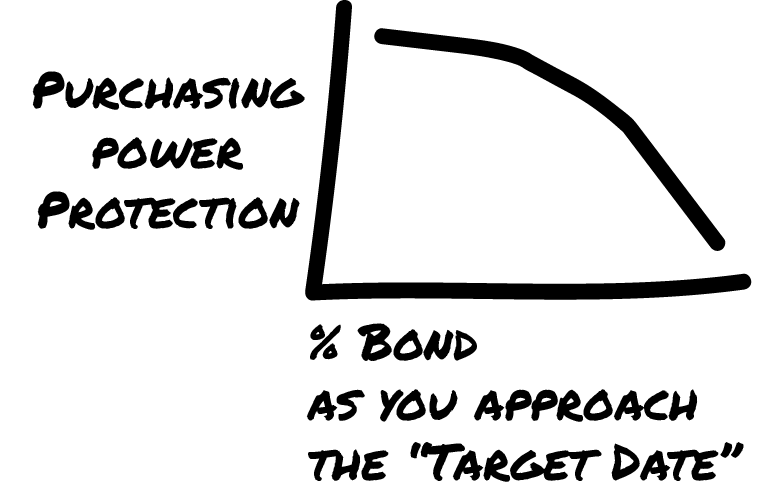

Target-date funds have become widely used among participants in employer-sponsored plans. Vanguard reports that 78% percent of retirement plan participants are using at least one target-date fund and that 54% of participants are only using target-date funds.1 These funds are touted as an easy, and hands-off approach to allocating retirement funds. Target-date funds are designed to automatically shift the employee’s allocation from equity (stock) investments to bonds as the employee ages and approaches retirement. As we’ll discuss, simpler often isn’t better, or even good. It’s problematic.

The shift from equities to bonds, which is exacerbated in today’s interest rate environment, will likely result in the failure of employee’s plan if left to “self-guide.” The goal in retirement is to produce an income to meet or exceed your employee’s standard of living and maintain that standard of living through a retirement that could last 3 decades, highlighted by rising costs. The primary retirement income goal of any plan worthy of its name should be to provide a retirement income source that will keep pace with rising costs. Any other outcome will result in declining purchasing power and the increased chance of employees running out of money in retirement. Objectively, they’ve worked too hard to become entirely reliant on Government sources or family members to live their final years.

Historically, well-diversified equity ownership is the way to accomplish this; otherwise, your employees risk running out of money in retirement.

Shifting funds from the only asset class with a long-term track record of exceeding inflation to one that won’t seems to be a bad idea. Target-date funds not only encourage this, they practice it!

Target-date funds give the illusion of safety and security, but the systematic shift to a lower-performing asset class can be disastrous for the employee to and through retirement. Effective communication and hands-on planning assistance are essential to implementing and maintaining an appropriate asset allocation. This guidance certainly cannot be replaced by the Target-date fund.