Will you outlive your money

or

Will your money outlive you?

There’s only one of two ways this can go. Any retirement plan has the potential help each employee achieve the “second outcome”, living a life in retirement that is free from economic worry while leaving a legacy for future generations. Or, said another way: “the money outliving the employee”.

Our clients, families, friends, co-workers, (that is: all employees) benefit from beginning the discussion with “the question” and figuring out “the answer”.

How much will I need to retire?

Am I on track to get there?

How do I know if I am on track?

What do I need to do?

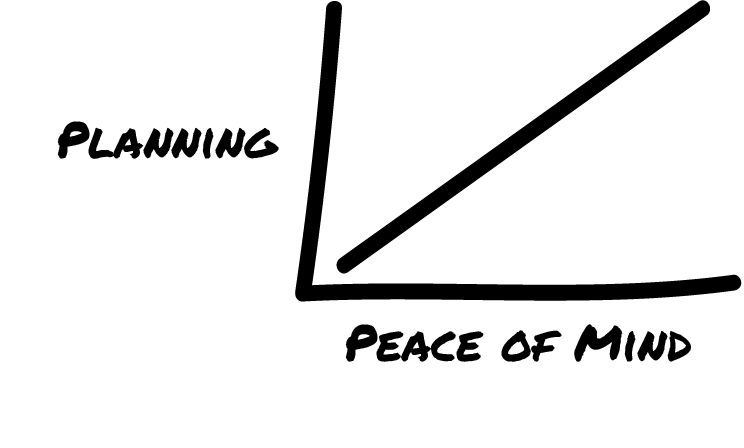

The correlation is unmistakable. Plan now, relax, and manage the plan.

Guiding employees to focus on identifiable long-term goals increases the likelihood that they will stick to their plan. For example,

- What income will I need to earn in retirement and how much should be saved each payday to successfully achieve this goal?

- Does the current investment mix to achieve this goal?

- Does the “current market”, “trends” or “economic forecasts” have any impact on my plan?

The retirement plan that your organization offers can provide the foundation for and path to a successful retirement for each of your employees. Retirement plan communications can be better. Focus on the plan and not “the moment”.

If done properly, a successful retirement is within reach for each employee.